News - Inflation Woes Persist Amid Signs of Economic Stability

Business Strategy

Inflation Woes Persist Amid Signs of Economic Stability

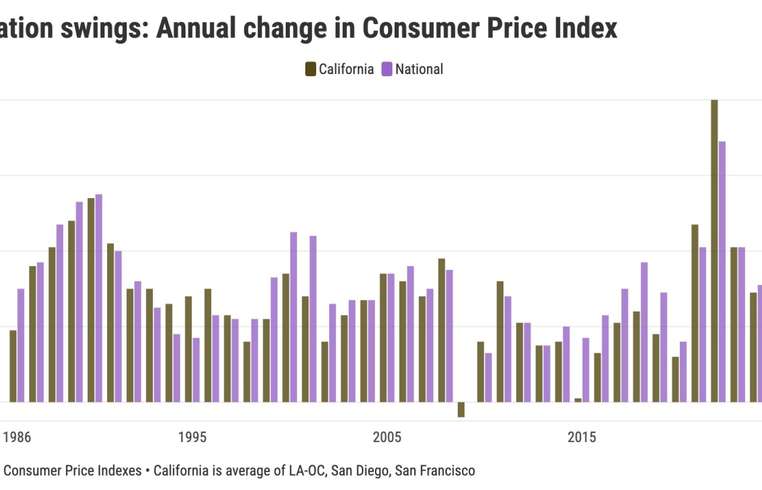

In recent discussions of economic health, a picture of stabilized inflation emerges across both California and the nation. Tracking the Consumer Price Index shows a return to historical norms, with California consumer prices up by 3.1% last year, mirroring the state’s four-decade average. National data echoes this sentiment with a 2.6% rise, a stark contrast to the alarming 8% peak seen in 2022. Despite these metrics suggesting a return to stability, consumer anxieties remain, particularly among households delicately balancing budgets. The inflation surge left its mark, reminding many of historical precedents and economic turmoil typical of California's volatile past. Before the Great Recession, inflation in California oscillated around similar levels to today's, punctuated by significant economic events like real estate bubbles and the dot-com boom. Post-Recession years were a stark contrast. With suppressed demand and muted housing costs, inflation cooled significantly, creating a false sense of economic peace that was shattered by the pandemic. This pandemic-induced economic shift propelled inflation to new heights, resulting in significant yearly increases in living costs, both at state and national levels. The economic narrative, however, doesn't solely pivot around price indexes. It encompasses a vital, often overlooked dimension: wages. While indexes indicate an economic balance, individuals often experience varied realities based on personal income and expenditure patterns. Wage growth, despite rising significantly in recent years, has not uniformly alleviated financial stress, especially for those on fixed incomes. This varied economic impact underscores the persistent chasm between economic statistics and personal financial realities. In California, household incomes have shown significant growth, outpacing inflation rates seen in the years following the Great Recession. Nationally, similar trends signify an income rising tide. Nonetheless, while incomes climb, so do costs, leading to a cycle where businesses pass on labor costs to consumers, perpetuating inflationary pressures. Ultimately, while reports of moderated inflation may offer a macroeconomic sigh of relief, the on-the-ground financial strain, particularly within diverse economic sectors, remains palpable, fueling ongoing discussions about true economic stability and resilience.